An officer’s salary is never part of the « cost of goods sold. » Instead, an officer’s salary is typically considered to be an overhead expense. Travel costs are generally considered expenses and not cost of goods sold (COGS). This is because travel costs are not directly tied to the production of goods or services. Instead, they are expenses incurred by employees or individuals in the course of performing their jobs or providing services. COGS, short for costs of goods sold, has substantial influence on your business’s taxable income.

What Cost Of Goods Sold Does NOT Include

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. While this may entail a higher initial investment, it can pay off in the long run by reducing your overall costs. One way to reduce your COGS is to negotiate better prices from your suppliers. There’s nothing wrong with your report, and Cost of Good Sold isn’t posting twice.

Cost of Goods Sold for Product Businesses

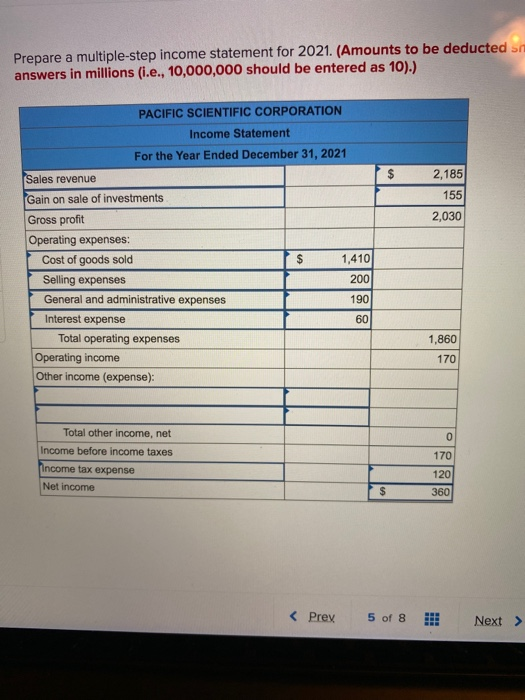

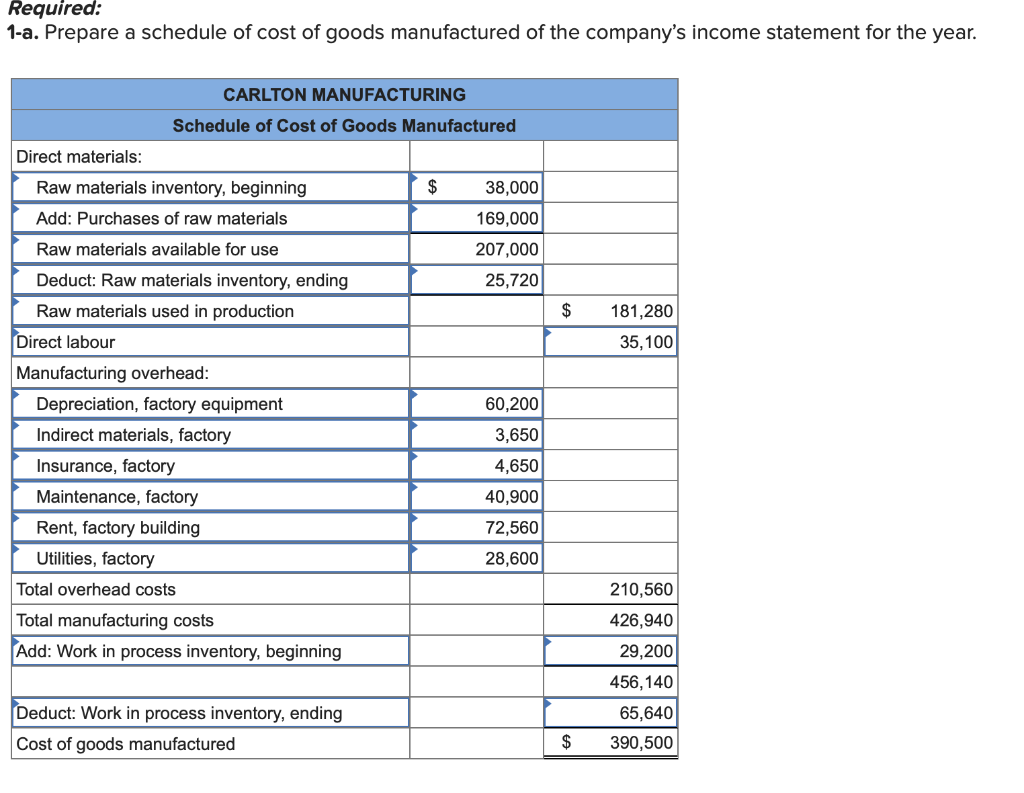

Thus, in an inflationary environment where prices are increasing, this tends to result in higher-cost goods being charged to the cost of goods sold. Here in our example, we assume a gross margin of 80.0%, which we’ll multiply by the revenue amount of $100 million to get $80 million as our gross profit. Generally speaking, COGS will grow alongside revenue because theoretically, the more products and services sold, the more must be spent for production. The calculation of COGS is distinct in that each expense is not just added together, but rather, the beginning balance is adjusted for the cost of inventory purchased and the ending inventory. As another industry-specific example, COGS for SaaS companies could include hosting fees and third-party APIs integrated directly into the selling process.

Related AccountingTools Courses

Using recycled or responsibly sourced materials can also decrease raw material costs over time. One meaningful method of adapting corporate social responsibility is through the management of supply chains. Companies can align themselves with suppliers committed to sustainable practices.

The titles services as header to track your transactions accordingly. Moreover, the Total Cost of Goods Sold section can’t be removed from there. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

This method gives you the COGS for the period, reflecting the direct costs of goods that were sold. No matter how COGS is recorded, keep regular records on your COGS calculations. Like most business expenses, records can help you prove your calculations are accurate in case of an audit. Plus, your accountant will appreciate detailed records come tax time.

This method is most accurate when pricing products remains relatively stable over time. COGS does not include the four major components of research and development costs, general and administrative expenses, non-manufacturing overhead, and income taxes. Under the last in, first out method (LIFO), the cost of the last unit to enter inventory is charged to expense first. In an inflationary environment, this means that the most expensive (newest) inventory items are charged to expense first, which tends to minimize the reported profit level. It also means that the ending inventory level is kept as low as possible.

- Therefore, a business needs to determine the value of its inventory at the beginning and end of every tax year.

- To calculate it, add the beginning inventory value to the additional inventory cost and subtract the ending inventory value.

- Not only do service companies have no goods to sell, but purely service companies also do not have inventories.

- If COGS is not listed on a company’s income statement, no deduction can be applied for those costs.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Understanding what COGS is and how to calculate it can be an essential part of being a successful business owner. Get instant access to video lessons taught by experienced investment bankers.

Salaries and other general and administrative expenses are not labeled as COGS. However, there are types of labor costs that may be included in COGS, provided that they are directly related to producing the primary product or service of the company. For example, if a company manufactures clothing, the salaries of sewers and cutters would likely be included in COGS, as they are directly involved in the production process. However, the salary of the CEO would not be included, as he or she is not directly involved in production. Costs that are not included in the cost of goods sold are anything related to sales or general administration. These costs include administrative salaries, as well as all utilities, rent, insurance, legal, selling, and other costs related to selling and administration.

Cost of goods sold is the direct cost of producing a good, which includes the cost of the materials and labor used to create the good. COGS directly impacts a company’s profits as COGS is subtracted from revenue. If a company can reduce its COGS through better deals with suppliers or through more efficiency in the production process, it can be more profitable. COGS is an important metric on financial are salaries part of cost of good sold statements as it is subtracted from a company’s revenues to determine its gross profit. Gross profit is a profitability measure that evaluates how efficient a company is in managing its labor and supplies in the production process. It is important to note that operating expenses are necessary for the day-to-day functioning of a business, even if they are not directly tied to the production process.

If a company orders more raw materials from suppliers, it can likely negotiate better pricing, which reduces the cost of raw materials per unit produced (and COGS). Alas, if this is the first time you’re running a COGS formula, you’ll have to calculate both your beginning and ending inventory. But from this point forward, you’ll need to calculate only your ending inventory. Because one period’s ending inventory will always equal your beginning inventory for the next period. COGS represents the actual costs incurred to produce and sell goods, so it should always be a positive value or zero. We will also include examples to help you understand the process of calculating the cost of goods sold.